Our Philosophy and Investment Criteria

Creating and nurturing key industries via open innovation for the prosperity of future generations

INCJ Investment Policy

Three main investment principles

Alignment with the long term needs of society

- Address environmental and energy issues in Japan and worldwide

- Help people live long, healthy lives

- Boost the productivity of the national economy

Growth

- Able to generate new added value

- Likelihood of additional funding from private enterprises

- Able to dispose of the acquired shares

Innovation

- Concentrate and deploy cutting-edge base technologies

- Gather management resources of enterprises such as venture companies, and utilize them

- Technology focused business consolidation and integration

- Utilize management resources other than those found in Japan

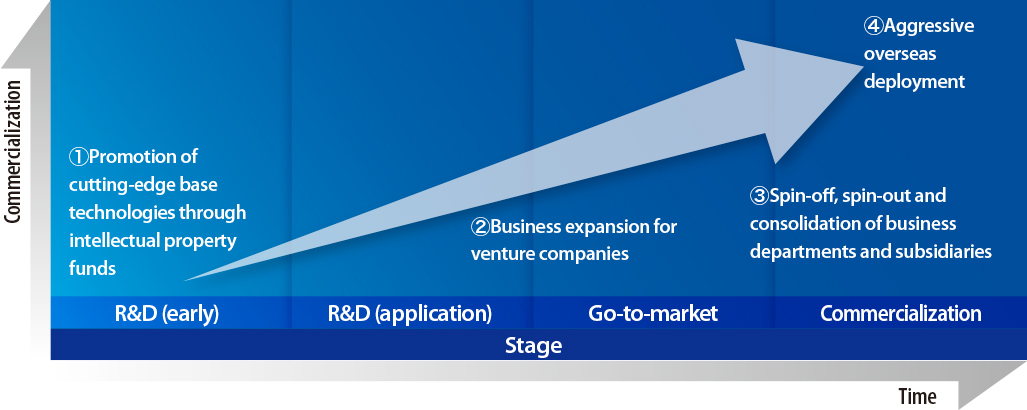

Stages of commercialization in our investment target

Investments in various stages of commercialization

Sector focus

INCJ invests in a wide range of industries, and businesses, which are thought to require revitalization through open innovation

Current and past areas of investment

- Materials and chemicals

- Electronic devices

- Industrial machinery

- Energy

- Transportation and automotive

- Consumer goods and retail

- Health and medicine

- IT, business services, and content

- Infrastructure

- Intellectual property

Investment scenarios

Diverse investment methods aimed at achieving high investment impact

- Vertical integration

- Horizontal integration

- Cross-border M&A

- Spin outs and spin offs

- Growth and seed investments

- Fund of funds

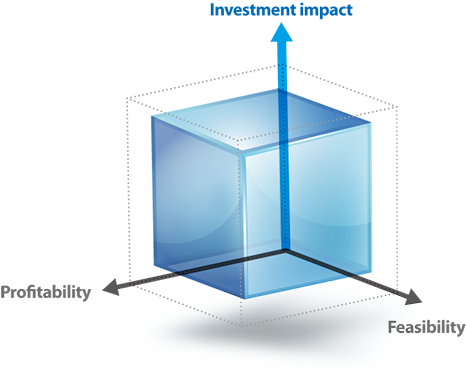

Criteria for assessing deals

- 1. Investment impact

- A third assessment criterion, particular to INCJ:

the potential benefit to society

- A third assessment criterion, particular to INCJ:

- 2. Profitability

- Assessed in the same way as a private fund

- 3. Feasibility

- Assessed in the same way as a private fund